Week ending 29th August 2025

9/1/2025

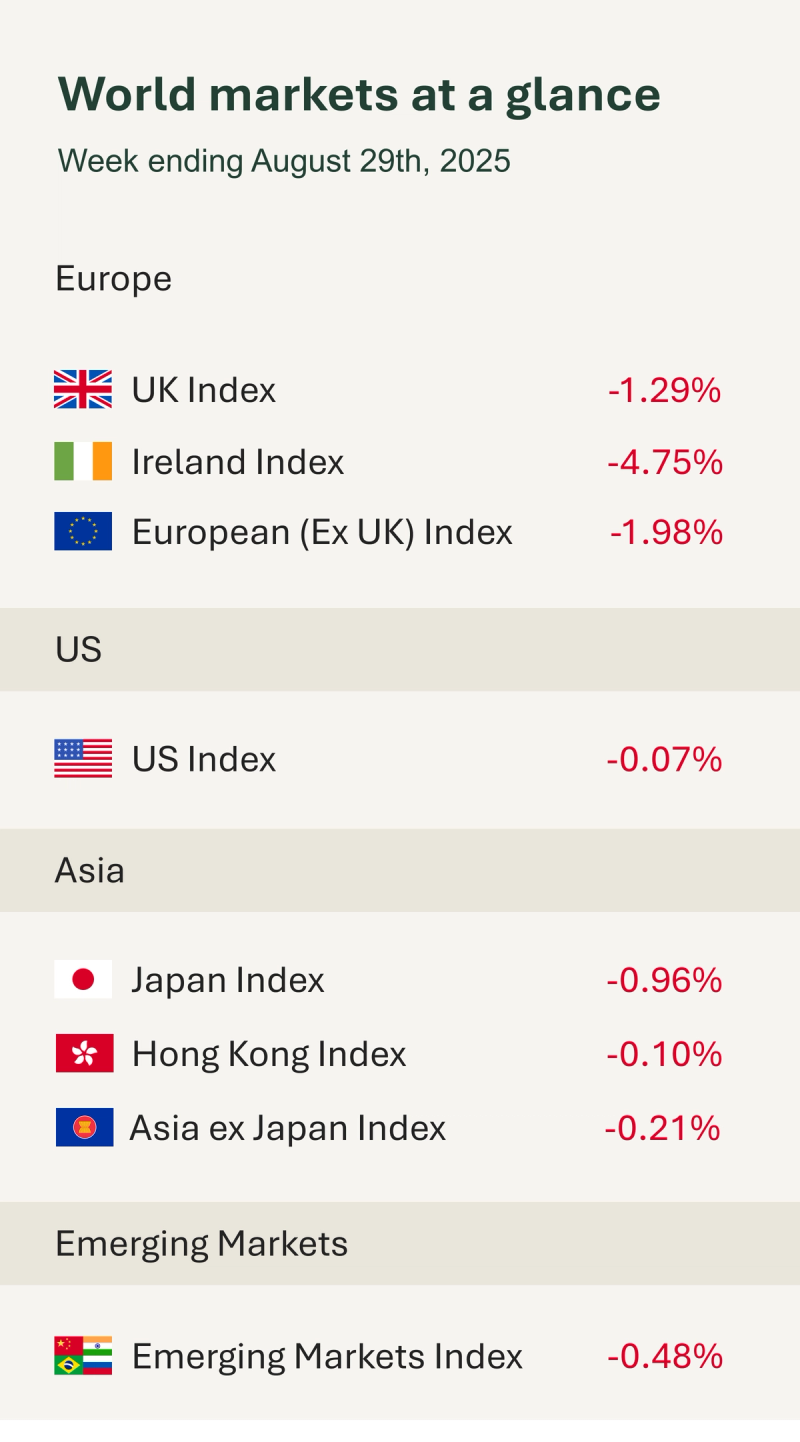

As shown in the table, it was a mixed week for markets. It was a shortened trading week in the UK, with markets closed on Monday for the bank holiday. US markets also saw light volumes ahead of the long weekend with markets closed for Labor Day on Monday 1st September.

US equities ended the week slightly lower. Gains were tempered by political noise after President Trump sought to dismiss Federal Reserve Governor Lisa Cook over alleged mortgage misstatements, an unusual move that raised concerns about central bank independence. While generating noise in markets, the action is unlikely to affect monetary policy in the near term, with Chair Powell reaffirming the Fed’s independent status and data-driven decisions.

US economic data provided some reassurance. The second estimate of Q2 GDP was revised up to 3.3% from 3.1%, underscoring the underlying strength of the economy. Inflation in July held steady: core PCE, the Fed’s preferred gauge, rose 0.3% month-on-month and 2.9% year-on-year in July, slightly above forecasts. Consumer spending also climbed 0.5% on year in July, highlighting household resilience. Despite earlier concerns that President Trump’s tariffs could spark higher inflation and slow growth, the impact is not yet obvious in the data. For now, growth looks intact, and consumer demand remains resilient, keeping attention squarely on the Fed’s next steps.

On Friday, a US federal appeals court ruled Trump exceeded his authority in imposing global tariffs under emergency powers. The tariffs remain in place until at least 14th October pending appeal, adding uncertainty to trade policy, though the White House signalled it may seek alternative legal grounds to maintain them.

In the UK, the FTSE 100 closed the week lower, weighed down by weakness in banking stocks. Pressure mounted on Friday after a think tank proposed a windfall tax on profits from reserves held at the Bank of England. The Treasury declined to comment, leaving markets in a state of speculation. Defence names, however, advanced with Rolls-Royce among the gainers after German Chancellor Merz downplayed prospects for Russia-Ukraine peace talks, reinforcing demand for defence assets.

European equities softened as France faced renewed political risk. French Prime Minister François Bayrou called a September 8th confidence vote on his austerity budget, which includes cutting public holidays and freezing benefits. With opposition parties pledging to vote against it, markets are pricing in not just the risk of Bayrou’s government falling but the possibility of prolonged political instability. Trade news provided a silver lining: the European Commission proposed scrapping duties on imported US industrial goods in return for lower US tariffs on European cars.

Chinese equities posted a stronger week than their counterparts, led by optimism surrounding the AI and chip sector. Major indices have outperformed this month despite lingering headwinds such as deflationary pressures and trade disputes.

Looking ahead, key data releases include Eurozone unemployment, inflation and retail sales, followed later in the week by UK retail sales, and in the US, initial jobless claims, nonfarm payrolls, and unemployment figures.

Amy Sharpe, Investment Analyst