Autumn Budget 2025

The Chancellor of the Exchequer, Rachel Reeves, has today delivered the Autumn Budget.

ISAs

The Chancellor has today announced that the Cash ISA limit will be reduced to £12,000 for those aged under 65 from April 2027. The Chancellor referenced differences in longer-term historical returns from Cash ISAs and Stocks & Shares, with the intention being to incentivise savers to invest. Over 65s will retain the ability to contribute the full £20,000 towards a Cash ISA.

Other ISA allowances remain unchanged:

•Stocks and Shares ISA - £20,000

•Junior ISA - £9,000

•Lifetime ISA* - £4,000 (excluding government bonus)

•Child Trust Fund - £9,000

*The government will publish a consultation in early 2026 on the implementation of a new, simpler ISA product to support first time buyers to buy a home. Once available, this new product will be offered in place of the Lifetime ISA.

Dividends

From April 2026, the basic and higher dividend tax rates will increase by 2%:

•Basic rate – 10.75%

•Higher rate – 35.75%

•Additional rate – 39.35% (unchanged)

The dividend allowance of £500 will also remain unchanged.

Pensions

It was announced that salary-sacrificed pension contributions will be capped at £2,000 from 2029. This means that employees who contribute up to £2,000 into their pension each year via salary sacrifice can continue to benefit from pension contributions that are free of income tax and National Insurance. Contributions over £2,000 will result in employee and employer National Insurance charges on the amount above £2,000.

The Annual Allowance for pension contributions remains unchanged at £60,000, and there has been no change in the rate of income tax relief applicable.

The standard pension Lump Sum Allowance remains at £268,275.

Income Tax

The Chancellor kept the Labour manifesto pledge not to raise the rate of income tax, National Insurance or VAT; however, the freeze on income tax thresholds has been extended for a further 3 years to April 2031.

While freezing income tax thresholds may not appear to be a change, as wages rise over time, frozen thresholds mean more people are pulled into higher income tax brackets without any formal rate increase (known as fiscal drag). This would also impact how much capital gains tax, savings tax and dividend tax is charged for people who inadvertently move into higher income tax brackets.

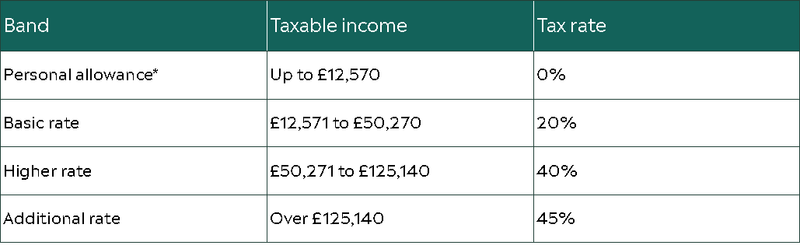

As a reminder, the income tax rates and thresholds for the 2025/26 tax year in England, Wales and Northern Ireland are:

*Your Personal Allowance may be greater than £12,570 if you claim Marriage Allowance or you are eligible for the Blind Person’s Allowance. Those earning more than £100,000 will see their Personal Allowance reduced by £1 for every £2 earned over £100,000 and is zero if your income is £125,140 or above.

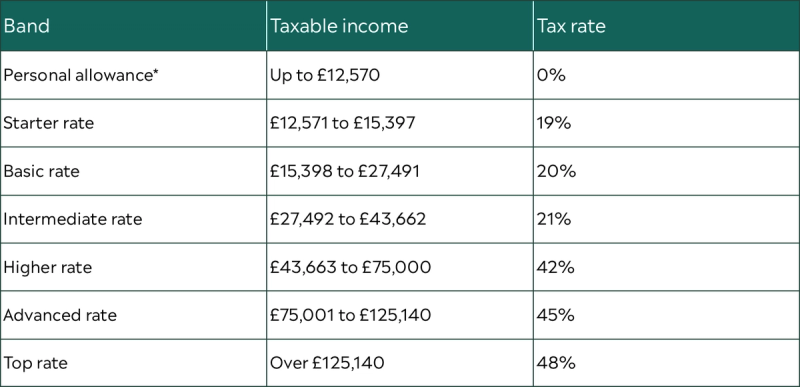

2025/26 Income tax rates for Scotland

*As with the rest of the UK, those earning more than £100,000 will see their Personal Allowance reduced by £1 for every £2 earned over £100,000 and is zero if your income is £125,140 or above.

Capital Gains Tax (CGT)

The Annual Exempt Amount for capital gains tax remains unchanged at £3,000, and the tax rates applicable also remain unchanged at 18% and 24% for basic and higher rate taxpayers respectively.